new haven county property taxes

Address 165 Church St. If New Haven County property tax rates are too costly for your revenue resulting in delinquent property tax.

Connecticut Property Tax Calculator Smartasset

Board of Alders City Services and Environmental Policy Committee.

. I will also be accepting payment in person at the New Haven Township Hall on these dates. A serviceman having any questions in regard to motor vehicle property taxes or in need of an application to complete and file in sufficient time to meet filing dates to apply for such benefits. These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes.

For comparison the median home value in New Haven. 111 of Assessed Home Value. There are 15 Treasurer Tax Collector Offices in New Haven County Connecticut serving a population of 862127 people in an area of 605 square milesThere is 1 Treasurer Tax.

232 of Assessed Home Value. Estimated Real Estate Property Tax Calculator. New Haven County Property Records are real estate documents that contain information related to real property in New Haven County Connecticut.

Phone 203 946-4800 Address 165 Church St. Assessments Property Taxes. 0530 PM - 0730 PM.

City Assessor Alex Pullen Email. Taxable property includes land and. The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate.

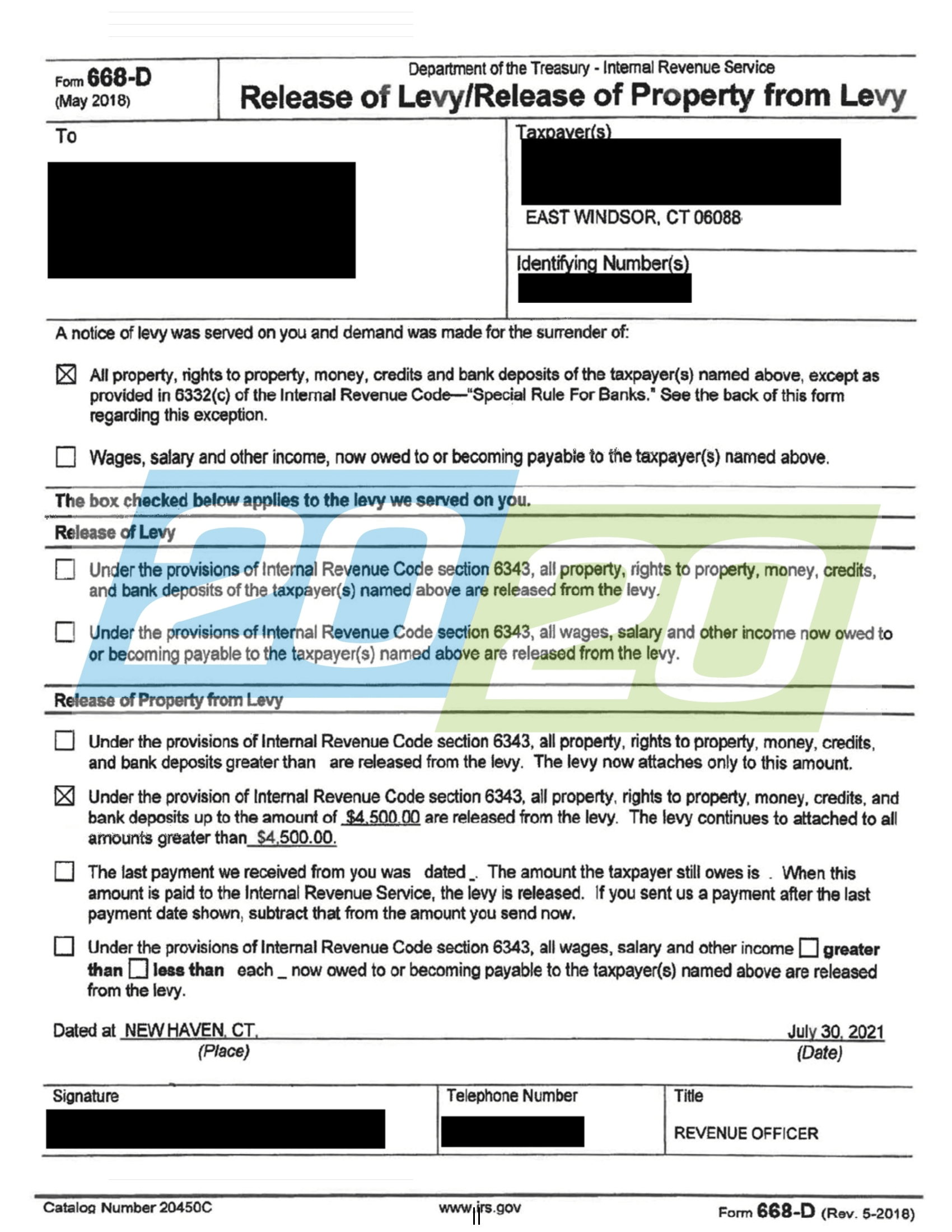

213 of Assessed Home Value. Effective tax rate New Haven County. All outstanding vehicle taxes associated with your name andor VINplate including taxes not yet delinquent must be paid in full for a release.

1st Floor New Haven CT 06510. The New Haven County Assessors Office located in New Haven Connecticut determines the value of all taxable property in New Haven County CT. 0600 PM - 0800 PM.

Account info last updated on Oct 2 2022 0 Bills - 000 Total. Certain types of Tax Records are available to the. Important DMV Release Notice.

Port Authority Board of Commissioners. View Cart Checkout. New Haven CT 06510 Office Hours Monday - Friday 900am - 500pm.

Then a hearing concerning any planned tax increase has to be convened. There are 15 Assessor Offices in New Haven County Connecticut serving a population of 862127 people in an area of 605 square milesThere is 1 Assessor Office per 57475 people. New Haven County collects on average 169 of a.

The Town of New Haven property values on average have risen 247 in the last 10 years from a Total Equalized Value in 2008 of 127582000 to a. City Of New Haven. Enter an Address Owner Name Mblu Acct or PID to search for a property.

Office Hours Monday - Friday 900 am. Summer tax bills must be paid by September 14 2022 to avoid interest. Public Property Records provide.

Revenue Bill Search Pay - City Of New Haven. The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

City of New Haven per the FY 2022-2023 Mayors Proposed Budget Please note that this calculator returns an approximate value and.

Tax Solutions In Connecticut 20 20 Tax Resolution

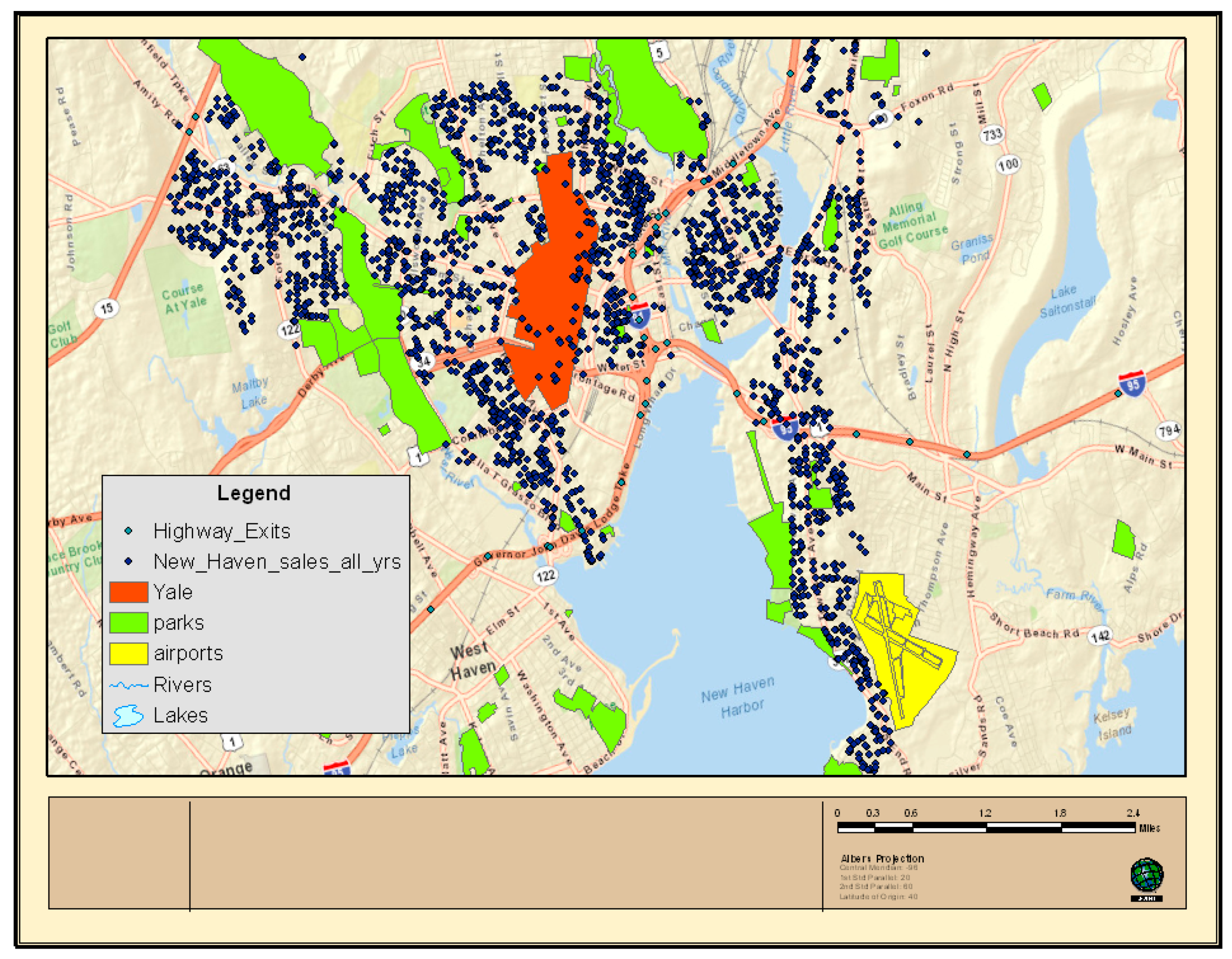

Yale S Tax Exempt New Haven Property Worth 2 5 Billion

Buildings Free Full Text Where In Connecticut Is The Best Location For A Split Tax An Analysis Of Land Assessment Equity In Several Cities Html

53 Read St New Haven Ct 06511 Redfin

City Of New Haven Tax Bills Search Pay

16 Castle St New Haven Ct 06513 Redfin

Wrigley Mansion Property Tax Bill Jumped From 34k To 150k Chicago City Wire

New Haven Ct Cpa Accounting Tax Audit Advisory Services Firm Marcum Llp

Who Rules America Who Really Ruled In Dahl S New Haven

City Of New Haven Property Tax Assessment Deferral Programs Pdf Free Download

Welcome To Elm City Communities The Housing Authority Of New Haven

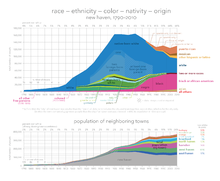

New Haven Connecticut Wikipedia

The New Haven Preservation Trust

Connecticut Tax Free Week Starts Aug 21 Here S What To Know